Earlier this month in Brussels, the longer term was most positively blue (… and that could be a good factor). Listed here are a few of the takeaways for many who weren’t there.

The Occasion

The Blue Make investments Day annual gathering celebrates and helps the expansion of the EU ocean/maritime group. Since its inception in 2018, Blue Make investments Day has grown into a robust catalyzing element in Europe’s blue ecosystem that features a digital platform and a dynamic group together with greater than a thousand innovators and dozens of devoted enterprise funds. Today is a part of the bigger Mission Restore our Oceans and Waters Discussion board 2025 that spanned your complete first week of March in Brussels.

Blue Financial system Competitiveness World Evaluation

In 2023 and 2024, Europe had extra Collection A funding offers within the blue financial system and extra early-stage funds devoted to the sector than North America and Asia/Oceania mixed. With the European Funding Financial institution (EIB)’s upcoming funding technique, the quantity of devoted funds ought to double (from 30 to 60) and its new blue financial system monetary devices of $230M ought to generate a 3X return in personal funding by 2030.

The EIB has recognized necessary funding gaps which might be hindering EU’s blue innovators’ competitiveness on the worldwide stage. In its report Europe Blue Champions launched at Blue Make investments Day, the EIB identifies advanced regulatory frameworks, a fragmented market, and limitations to entry late-stage capital as a few of the root causes of many post-Collection A enterprise deaths.

Moreover, excessive CAPEX necessities, lack of devoted late-stage funding, and inadequate sectorial market intelligence are shared ache factors for blue stakeholders globally. These mixed elements are contributing to a better danger within the sector, that are delaying or flat-out stopping investments and/or market adoption. The report calls out, “European enterprise capital funds are usually not prepared to commit massive quantities as a result of technological dangers related to most of these kind of initiatives, and personal fairness funds want to search for firms that already generate revenues. This may occasionally create a scenario the place firms which have obtained enterprise capital (VC) are usually not enticing but for personal fairness (PE).” The identical applies to blue funds exterior of the EU.

Olivier Raybaud, Managing Director of SWEN Capital Companions, additionally identified that many late-stage funds are usually not acquainted with the blue/maritime specificities, and on the opposite finish, blue scale-ups are sometimes not ready or arrange adequately to entry subsequent rounds of funding.

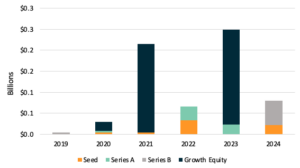

Blue Financial system Funding Developments: North America

Blue Financial system Funding Developments: Europe

![]()

A Sustainable Pathway to Blue Ecosystem Constructing

Since 2018, Blue Make investments has contributed to the creation of many devoted funds within the EU, however it’s nonetheless an rising and delicate ecosystem that requires public assist.

- Canada’s Canada Ocean Supercluster (Ambition 2035 Technique) and Enterprise Improvement Financial institution of Canada (BDC) are actively contributing to funds creation and direct dilutive/non-dilutive funding. Canada’ s Revolutionary Options Canada, facilitates innovators’ entry to authorities contracts, and must also be a supply of inspiration for Europe.

_ - In Singapore, which is the #1 blue start-up ecosystem and a serious delivery hub, main funds, together with sovereign and personal investments, can be required to realize its formidable Net2050 objectives and absolutely faucet into its blue financial system potential, in line with

_ - Japanese CVCs led by personal firms reminiscent of Idemitsu, ENEOS, and MOL are supporting the event of the blue ecosystem, pushed by the J-Credit score Scheme.

_ - The Asian Improvement Financial institution Institute (ADBI) can also be engaged on blue influence monetary devices that may profit its nation members.

_ - The U.S.’s Nationwide Oceanic and Atmospheric Administration (NOAA) will focus totally on early stage/Collection A acceleration applications, which has but to be deployed, however of word is that the provision of late-stage personal capital is much less of a problem. Actually, most international ventures are nonetheless turning to the U.S. on the subject of submit Collection-A VC funding within the blue financial system sector.

Specializing in Innovation Sandboxes and Regional Blue Financial system Methods

The creation of regulatory sandboxes is one other key driver of ecosystem progress. Usually {hardware} heavy, blue financial system ventures are needing check beds for his or her first pilots.

Collaborating with native industrial companions, COVE and ThePier in Halifax, Washington Maritime Blue in Seattle, or AltaSea within the Port of Los Angeles, are glorious examples of such sandboxes which have collectively generated a whole bunch of profitable ventures in North America. Idemitsu’s Blue Carbon Innovation Studio in collaboration with Hatch Blue can also be an fascinating mannequin stemming out of Southeast Asia/Japan.

One other key suggestion is a deal with regional blue financial system methods. Discussion board Oceano’s Hub Azul technique that’s being deployed on the nationwide stage in Portugal or Genova’s Blue District in Italy had been featured prominently throughout Blue Make investments Day as regional champions.

The Want for Strong Market Intelligence

All through roundtables and panel discussions at Blue Make investments Day, one factor turned abundantly clear: the necessity for strong sectorial knowledge.

The blue financial system is a large but nonetheless rising sector that may section additional because it grows. It is likely one of the quickest rising VC sectors, carefully adopted by power and semiconductors, but it represents solely 7% of all cleantech offers. We’re witnessing a mixture of first-generation generalist blue funds and new local weather funds which have lately extrapolated their funding thesis to incorporate some parts of the blue financial system. Lots of them are specializing in pre-Seed to Collection-A funding. The capital stack consists of new blended finance instruments and evergreen/influence/philanthropic funds, in further to public assist and financial incentives in lots of international locations.

With that in thoughts, Cleantech Group has created Open Waters Market Intelligence, an annual subscription service that can be that includes international complete knowledge and experiences on rising blue applied sciences, investments, and capital stack. Your suggestions and options are welcome. Keep tuned for our first report on the blue capital stack in Could.

For extra data or feedback, contact me at amelie.desrochers@cleantech.com.