Operators are transferring via the gears with 5G SA and 5G-Superior, balancing cap-ex constraints, operational complexity, and unsure returns. Whereas slicing, RedCap, and personal 5G present promise, most are prioritizing effectivity and focused enterprise providers over huge spending – reflecting the business’s seek for lifelike, sustainable monetization past client markets. (Be aware, that is an excerpt from a brand new 5G Market Pulse report, out there to obtain without spending a dime right here; the unique introduction and former entries have been revealed on-line right here and right here and right here.)

In sum – what to know:

Cautious transition – operators are shifting step by step to 5G SA and 5G Superior inside tight budgets, avoiding one other huge capex wave.

Advanced decisions – carriers face tangled selections round SA, cloud, spectrum, and APIs, slowing market progress.

Enterprise gambles – future income hinges on enterprise providers like slicing, RedCap IoT, non-public networks, and NTN.

The purpose (see earlier entryt and so on) is that spending won’t all of a sudden spiral upwards; operators are usually not about to gamble the home on area of interest providers on imprecise guarantees of incremental returns. “It’s unlikely 5G-Superior will gas one other main cap-ex cycle. As an alternative, operators will step by step transition their spending from 5G (SA) to 5G-Superior inside confined cap-ex budgets.” Pongratz cites the instance of China Cell, which plans to scale back its capital expenditure (cap-ex) on 5G by 22 p.c in 2024/25 whereas additionally launching 5G-Superior in 300-odd cities this yr. Once more; it is because there isn’t a such factor as a sure-thing amid the scattered gambles on 3GPP characteristic units in releases 16-through-20. Again to Douglas at Spirent, who picks up each factors – in regards to the empty NSA hype, and the conservatism within the SA on line casino.

He explains: “Firstly, if I’m blunt, the business ought to by no means have gone with [the 5G marketing around] NSA. It was an enormous mistake. As a result of it created this type of midway home that’s now accepted by the market – the place shoppers assume they’re getting 5G, once they’re solely getting a little bit of enhanced radio. There aren’t any providers round it, actually (aside from FWA, perhaps RedCap, perhaps non-public 5G). The second factor is the brand new SA system is sophisticated. It’s an entire cloud-native service-based structure. So it’s not nearly adopting new know-how and expertise; it’s about the entire operational setting and lifecycle of it – and the way to handle a cloud stack with a number of distributors doing a number of software program releases with a number of cadences, quite than simply each few quarters. It’s a large change.”

Spirent is aware of; the corporate is working with over 100 carriers in worldwide markets, testing SA rollouts with 30 of them, at the very least. He provides: “Even when it’s not as huge a cap-ex funding because the radio (with NSA upgrades), there’s an operational price down the road that cuts throughout many departments. Which has slowed down some investments. Plus, transferring to full SA has a significant influence on spectrum, as nicely, since you’re not sharing your 4G community anymore. So your 5G community must be adequate – or else you may degrade efficiency by migrating to a pure-5G community with out 4G aggregation… So there are lots of transferring elements to those SA upgrades. However all the operators are engaged within the course of. All of them need to do it. They’ve all received the enterprise instances behind it.”

Bolan at Dell’Oro Group is bolder, and goes additional to clarify the service conundrum to shift from NSA to SA, and past. Give them a break, he appears to say – or, at the very least, perceive the trivia of the sector’s personal digital change, which has seen its top-feeders hobbled by selection and indecision. “They’ve struggled with many decisions,” he says, writing them out for us: NSA versus SA, telco cloud versus public cloud, 5G core versus 4G/5G core, 4G voice (VoLTE) or 5G voice (VoNR); after which, once they have put all of it on black (“an SA core on a telco cloud”), they’ve confronted decisions between digital and naked steel servers, and the way to containerise cloud-native features. Even the “hype section” round non-public 5G has compelled them to supply hybrid and/or edge variations.

“A digestion interval set in,” he displays – “because the business spent tens of millions on enterprise trials… whereas enterprises determined whether or not or to not transfer ahead.” It should occur once more, he says, because the market offers with new launch 18-plus community options and programming interfaces (APIs) – and the way / why / when to launch reduced-capability (RedCap) providers for mid-range mobile IoT instances, non-terrestrial community (NTN) providers for back-woods and high-seas dead-zones, and no matter juiced-up synthetic intelligence and machine studying (AI and ML) functions go on prime of cellular networks after 2028. “These at the moment are seen as the newest efforts for operators to determine the way to monetize their investments in 5G,” says Bolan.

However decisions result in questions, he says. When will the mass (enterprise) market chew on non-public 5G? Will community APIs even scale out there – to make 5G-bound apps a “catalogue merchandise versus a customized merchandise”? Will NTN providers be viable – and shift top-line earnings, anyway? He feedback: “The jury is out on the timing [of all these technologies]… The business will undergo one other digestion interval that would take a number of years – perhaps 4 or 5 – earlier than we see extra market progress.” In opposition to such a posh backdrop, of technical upgrades and organisational shifts, and such a dynamic industrial local weather, about the way to orchestrate digital change towards the cadence of a dozen different ‘vertical’ markets grappling with the identical (see final chapter, pages 20), operators are left with a bunch of scattered gambles.

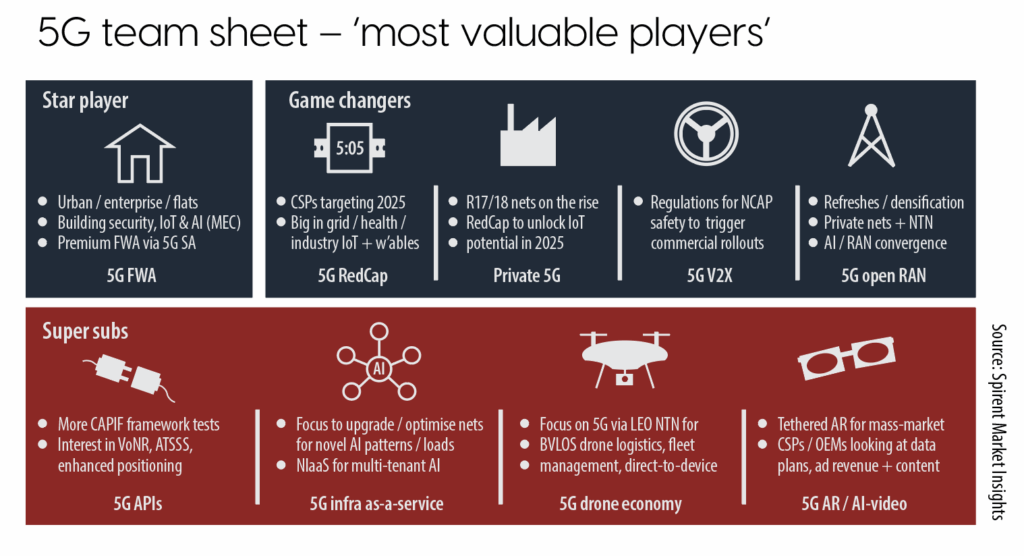

So what of those gambles? Which SA options will precipitate new revenues? Which ought to be relied on, individually or collectively, to shift the needle? Properly, guess what; Spirent has a slide (see under), and Douglas has a solution. He places these accumulator bets into some form of order, rating the ‘most useful gamers’ (as per the unique soccer analogy): FWA is the ‘star participant’, as mentioned, and 5G RedCap, non-public/hybrid 5G and slicing, and 5G vehicle-to-everything (5G-V2X) are ‘sport changers’, with the form of baller promise to get a end result, perhaps. In addition to, there’s a bench of ‘tremendous subs’: APIs to monetise intrinsic 3GPP options, infrastructure as-a-service (NIaaS) for multi-tenant AI, drone fleets and direct-to-device satellite tv for pc/NTN providers, and… AR spectacles, tethered to handsets.

As an inward trying infrastructure concern, open RAN is a ‘future sport changer’ too, “late to the sport” when 5G offers have been signed in 2019/20, however with potential to take share in brownfield refreshes and small-cell densification tasks via the second half of the 2020s, plus with non-public 5G deployments for enterprises and satellite tv for pc NTN rollouts. Douglas feedback: “RedCap is an actual precedence in lots of markets. There’s lots of testing, not simply on the gadget aspect however on the community aspect – together with with slices [and SLAs] and so forth. However the push is about optimising networks and spectrum, too. RedCap isn’t some holy grail for brand spanking new income. It’s extra about consolidating all that legacy mobile IoT stuff. It’s extra environment friendly with spectrum, and can free-up high-value bandwidth for different providers.”

Past, the speak in testing is about 5G SA and 5G Superior for public/non-public community roaming, mission-critical networks for first responders (within the US, notably) and railways (in Europe, as GSMR goes end-of-life in 2030), and community APIs and slices “so verticals… can use their enterprises credentials as a part of authorisation mechanisms to combine extra cleanly into their safety zones”. Operators are “very focused” to drive new income progress, reckons Douglas. However which maintain most promise?!!! After inevitable hype, adopted by some years of anti-hype (by self-proclaimed “slice deniers”; Dean Bubley, take a bow), slicing ought to be taken significantly, it appears. “There are auspicious indicators,” says Englert-Yang at ABI Analysis.

He factors to profitable trials and deployments with governments and enterprises – in China (client/enterprise) and India (client), notably. “From these, we see that slicing is a versatile know-how that may be mixed with IoT, QoS (quality-of-service), FWA, and extra for a extremely focused monetization strategy that fits every nationwide market.” The FCC has taken a “clearer place” on net-neutrality, he suggests as a point-of-note – “which helps telco investments”. He goes on: “There’s a lot of potential. Slicing capabilities are nonetheless evolving from static, predefined slices to semi-dynamic slicing with real-time management. This and different developments like improved mobility will include 5G Superior and will help slicing monetization long run.”

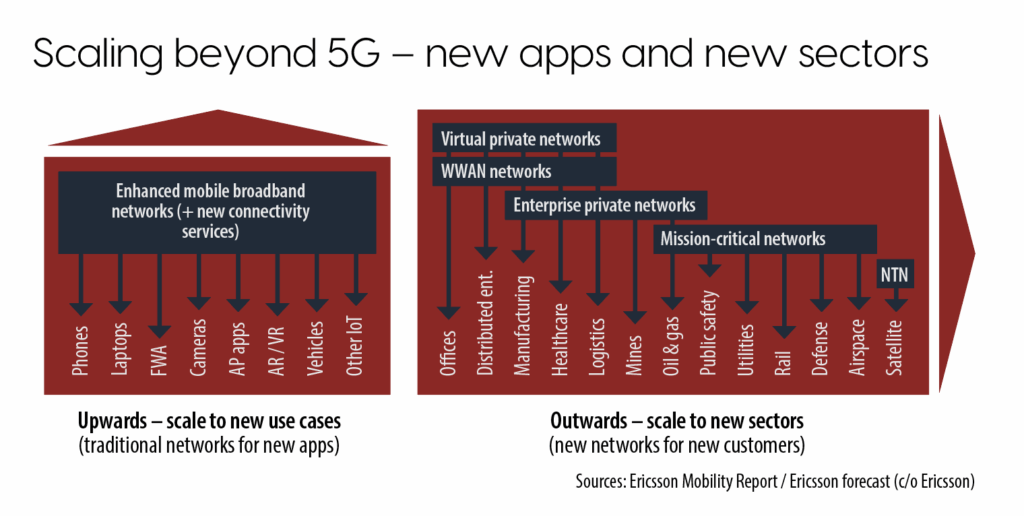

However all of these issues – aside from FWA, and wearables (and even ‘healthcare’ wearables fall each side of the road) – are enterprise providers, certainly? In London, Ekudden suggests “this 5G story” has “two vectors” going ahead, and presents a slide with them written as new ‘use instances’ and new ‘sectors’ (see above). The primary begins with FWA, he says, however quickly will get into “AR leveraging 5G” (a reference to AI glasses, which we’ll return to) as a “mass market [event], perhaps in 2027. In addition to, he flags rising curiosity in 5G-connected cameras, automobiles, and ‘different IoT’. The second “vector” is about 5G’s new position in manufacturing, healthcare, logistics, mining, oil and gasoline, public security, utilities, rail, defence, airspace… and, weirdly, satellites, tacked on the top like a ‘vertical’ market.

The satellite tv for pc/NTN ‘sector’ is a “complimentary know-how within the stack [which] permits this limitless attain”, he explains. However the message from Ericsson, about “the way to develop the worldwide cellular market past eight billion subs”, is that a lot of the imprecise alternatives that 5G would possibly allow are with enterprises, and never shoppers. “Enterprises are adopting 5G… for efficiency causes [or to support] a cellular workforce,” says Ekudden, happening to debate how 5G is morphing with wi-fi WAN and personal/hybrid community setups, earlier than placing forecast numbers towards the clearest vector-two alternatives, because the Swedish agency sees it.